Discover the TikTok Inspired App That Is Successful Around the World – MX TakaTak...

Since short videos are so popular nowadays, more and more apps are supporting short video content, just like TikTok. I discovered an exciting app like Tiktok that has other unique content and features as...

Discover This App to Earn Miles and Travel – How to Download for Free

The Miles app lets its users earn points by traveling, wherein one point for every mile covered. Then, these points can be redeemed into vouchers and gift cards. I recently discovered that the Miles app...

How to Remove Backgrounds from Photos Using CapCut App – Complete Tutorial

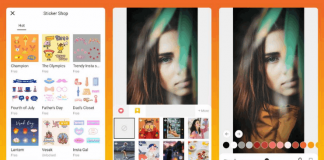

Nowadays, it is expected that everyone has at least basic knowledge and skills in photo and video editing because social media has become a staple in today's society. Photo editing skills are important because...

Huntington Mobile App – Learn How to Download and Use

Huntington Bancshares Incorporated is a Columbus, Ohio-based American bank holding company. The company ranks 500th on the Fortune 500 and 26th among the largest banks in the United States.Being one of the largest banks...

Discover Apps to Monitor Health

Getting healthy is something that is on everyone's mind at some point in time. Better health makes you feel better, increases your productivity, lowers your medical bills, and much more. That is why maintaining...

![Facetune Online: Convenient Photo & Video Editing App [Review]](https://gismoreview.net/wp-content/uploads/2023/05/phone-5146483-324x160.jpg)